The State Of The Venture Industry

Revaia Founding Partner Alice Albizzati appeared at the recent IPEM conference in Paris as part of a panel about the state of the venture industry alongside Sapphire Ventures President Partner and cofounder Jai Das and two prominent LPs: Vencap Senior Investment Manager Sion Evans and British Patient Capital Managing Director Christine Hockley. While tough questions are being asked, the case for venture’s role in funding the economy of tomorrow is clear.

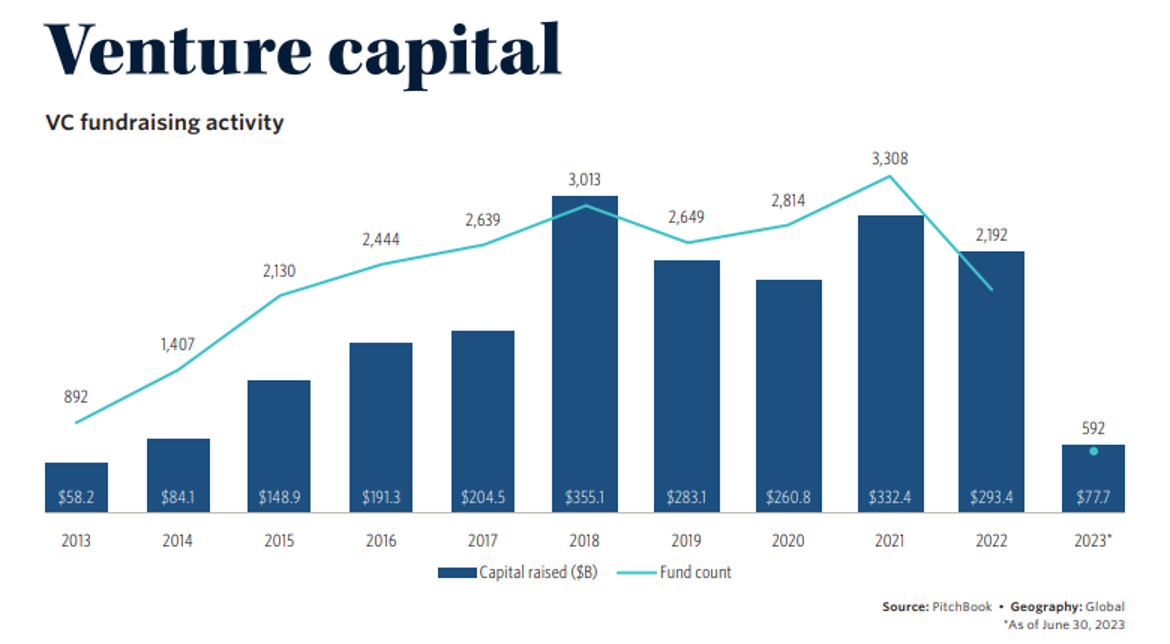

There has been a lot of debate about the state of venture capital and private equity investing since the big funding chill set in last year. Some critics have even questioned the very nature of the venture investing model, part of a backlash against risk capital firms for their roles in driving excessive valuations.

As Revaia celebrates its 5th anniversary this year, we’re certainly mindful of the need to adapt strategies to the changed macroeconomic environment. But nothing has shaken our confidence that the growth equity investing that we do is more vital than ever for accelerating the digital transformation that will build the economy of the future.

Revaia Partner Alice Albizzati recently had a chance to share this view and take the pulse of the VC industry while speaking at the IPEM conference in Paris where the theme was, “Destined To Outperform.” She participated on a panel that posed the question, “Has venture capital suffered a fall from grace?” She was joined by Sapphire Ventures President Partner and cofounder Jai Das and two prominent LPs: Vencap Senior Investment Manager Sion Evans and British Patient Capital Managing Director Christine Hockley.

While discussing the topic of whether the venture industry’s reputation has suffered, the panel agreed that the negative sentiment against venture investing is a bit too negative. Such high-risk bets are also long-term bets and will need more time and context to be judged properly.

“We're at a point in the cycle…where we were in 2019,” Christine Hockley said. “And I think historically, as we look at venture, what we know is that it's cyclical. We're in 70 funds and we're there to invest through the cycle. We’re called British Patient Capital and we are patient investors. So we're looking at venture as an asset class for the long term.”

While the data is clear that startup failure rates are increasing, the ultimate returns for a fund are determined by the size of the most successful investments, and not the percentage of successful companies versus failures. LPs understand this and continue to express support for this model of risk investing.

“People have really forgotten just how hard venture is to generate really strong performance,” said Sion Evans. “When we look at what generates performance, it's not the number of your losers. It's the size of your winners. For example, we looked at our portfolio across 30 years, and all the funds that generated over 3x to us and 87% of them had one investment returning the entire portfolio. ”

In terms of new investments, the goal is still to find the best of the best, the outliers that will deliver outsized returns.

“The strategy remains the same,” Jai Das said. “When we look at what generates that outperformance and generates those big returns, it's those real outlier companies. It's the top 1% of exits that drive the majority of exit value.”

Christine Hockley explained that despite the turbulence, British Patient Capital has largely stuck to its investment plan rather than making any radical strategic changes.

“We were investing 200 to 300 million euros a year and we continue to do that,” she said. “We're balancing our vintage risk throughout our portfolio. We're investing in the best fund managers, the ones that we believe can pick the best companies.”

Alice Albizzati also shared the belief that while macroeconomic conditions may fluctuate, there are several fundamental technological trends that are changing the way we do business and consume. While there may have been some excess in the COVID years, these megatrends are here to stay.

“The industry is not dead,” she said. “It's still $500 billion per year that is invested into this industry, Europe is gaining momentum and is gaining market share.”

Still, Funds of Funds and LPs are becoming more selective. Jai Das said he predicts that there will be a “flight to quality.”

“Most of these [LPs] are going to go towards firms which have returned capital, which have had a long history,” he said. “The dollars will go to the funds that have been doing well in previous cycles.”

He also noted that for many younger funds, this is likely their first major downturn. More experienced fund managers will know better how to help portfolio companies navigate difficult moments. And for that reason, many entrepreneurs might have a bias toward funds they view as more stable and that will be around for the long haul.

Sion Evans acknowledged that Vencap prefers to back established managers because they “really know when to double down” during such downturns, having operated through several such cycles before. He said Vencap saw strong returns on its investments between 2010 and 2013 thanks to a strategy of betting on experience.

“It shows you what's possible if you execute this next part of the cycle correctly, which is what's making us really excited about the coming years, despite the negativity, broadly speaking, around venture,” he said.

But Jai Das pointed out that emerging funds have their advantages as well. A larger platform with a lot of portfolio companies to manage might have a harder time making decisions about how to support each one while making new investment calls. Emerging managers with fewer startups can give each one more attention. And because their decision-making teams are smaller, these funds can move more quickly on deals. “Emerging managers can be much more nimble in these times,” he said.

Christine Hockley also suggested that emerging fund managers are leading the pursuit for startups in areas like deep tech, life sciences, and sustainability.

“These are the areas where the huge opportunities are going to be,” she said. “These will be the businesses that return the portfolio. And that does lead us to emerging managers because these are the managers that are looking at new technologies and that's certainly where we're focusing our attention.”

That echoes the experience at Revaia. While Revaia may be a younger fund, there remains tremendous support by LPs for such emerging funds that have a rigorous approach to investing and a clear thesis. Revaia’s portfolio has a growth rate above 50%, which is significant.

“What we're observing is that there is more selectivity,” Alice Albizzati said. “But there is great momentum for emerging funds if you stick to your financial discipline. There is no lack of confidence in what we are investing into and the performance over the long term.”

The gloomy outlook also tends to obscure that such moments create tremendous opportunities. For instance, as many of the large international alternative investors that drove some of the soaring valuations have pulled back their activity, that gives European funds an advantage when competing for deals.

And even if valuations are falling, entrepreneurs are still launching high-quality startups based on breakthrough innovations. Revaia has used this moment to invest in markets that are answering strategic fundamental needs such as climate change, security, and healthcare.

That has also meant helping portfolio companies seize the opportunities. Half of Revaia’s portfolio companies have closed M&A deals, for instance, allowing them to consolidate their market position and gain market share.

“If you're able to invest and stick to your discipline now, you can imagine that the performance will be quite good in the coming years,” Alice Albizzati said. “If you're able to have people on the ground to identify the best investment opportunities and also to help them scale, then this can be a good moment.”