Simulation Software and Digital Twins: The $200 Billion Technology Reshaping Industry

Few sectors have moved from buzz to boardroom priority as rapidly as simulation software and digital twins.

These technologies are undergoing remarkable transformations, evolving from specialized engineering use cases to essential technology powering innovation across industries ranging from manufacturing to healthcare. This momentum is building because simulation software and digital twins sit at the intersection of several major trends, including AI adoption, IoT expansion, and sustainability efforts.

They now represent one of the most promising and underexplored opportunities in enterprise software. While this market is set for potentially explosive growth, it can also be complex and challenging to understand.

So the Revaia team did a Deep Dive into this sector to better understand where value is shifting and why now is the moment to pay attention.

The Basics

Simulation software models real-world phenomena using mathematical formulas and rules, allowing users to observe operations without actual execution. Think of it as an experimental lab that doesn’t require a physical prototype.

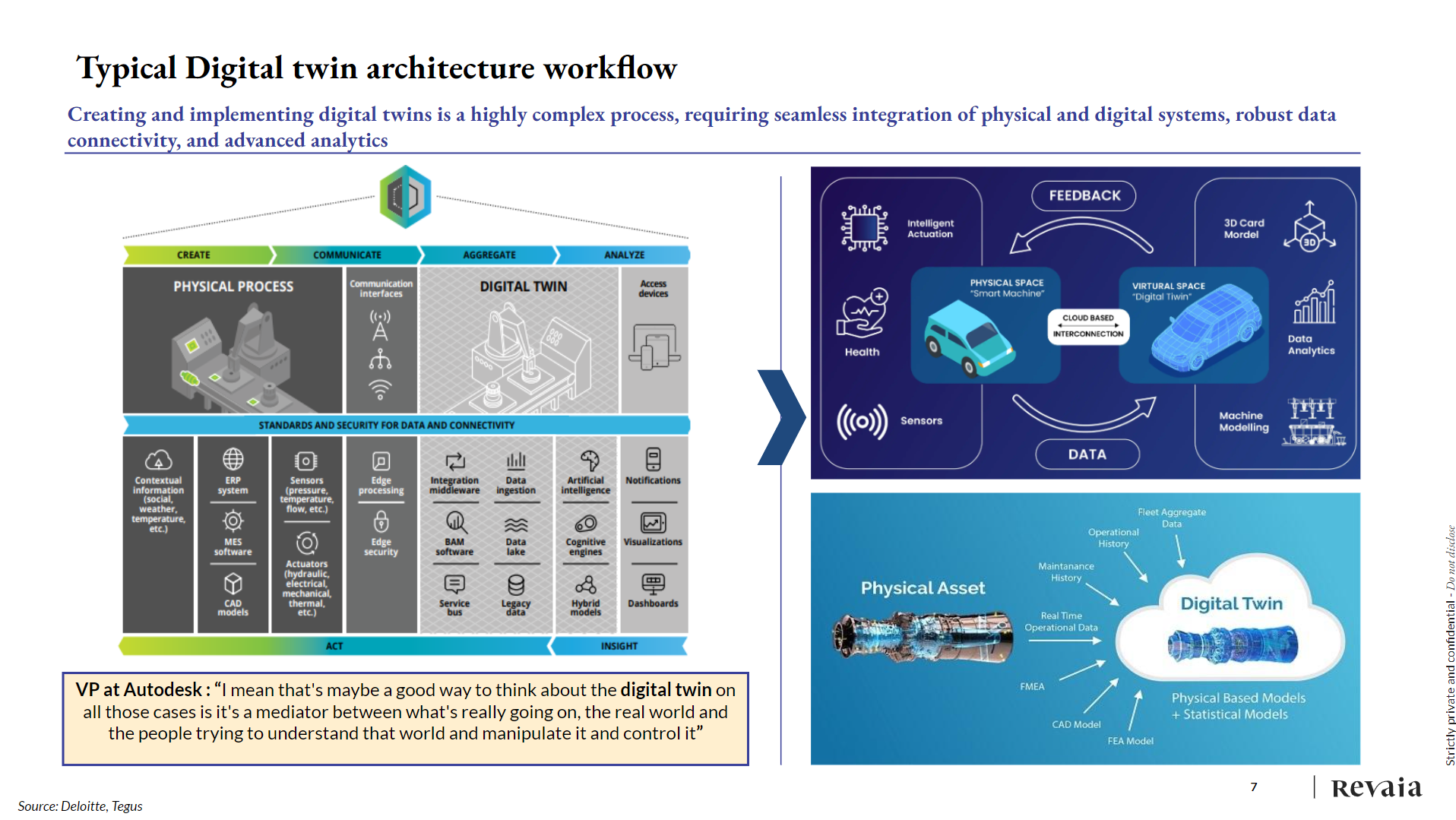

Digital twins build upon this foundation by creating real-time virtual replicas of existing or potential physical assets, systems, or multiple systems. These twins remain continuously connected to their real-world counterparts—whether that’s a jet engine, a heart, or an entire factory.

They don’t just simulate once; they mirror reality continuously. Fed by IoT sensors and powered by AI, they enable ongoing optimization, monitoring, and decision-making.

The relationship is symbiotic: simulation software provides the modeling backbone, while IoT/real-time data, AI/analytics, and cloud computing transform these models into comprehensive digital twins.

Digital twins exist across four levels of sophistication:

- Component twinning: Virtual representation of a single element (e.g., a bolt)

- Product twinning: Virtual representation of a complete product (e.g., a robotic arm)

- System twinning: Virtual representation of an entire process (e.g., a factory)

- Multi-system twinning: Virtual representation of interconnected systems (e.g., manufacturing, supply chain, and infrastructure)

Growth Drivers

Digital twins remain complex to build and deploy. The biggest hurdles include high implementation costs, data integration headaches, and a lack of skilled talent. Many organizations still struggle to bring together siloed systems or clean their data to the level needed for real-time modeling.

Yet the headwinds are weakening. AI is beginning to automate model building and inference. Cloud computing is easing the infrastructure burden.

As these breakthroughs lower deployment barriers, the rise of simulation and digital twin technologies is also being driven by a mix of mounting pressures and catalytic tech breakthroughs.

Industries are increasingly pressed to boost efficiency, cut costs, and meet sustainability mandates. At the same time, maturing AI, the explosion of IoT, and robust data analytics are making previously theoretical use cases not just possible, but profitable.

From predictive maintenance in aerospace to real-time energy load balancing and patient-specific treatment plans, digital twins are proving to be powerful tools across the value chain. At the same time, they are expanding into new domains, including healthcare, customer behavior modeling, and decision-making.

Digital twins have consistently ranked in Gartner's Top 10 Strategic Technologies for five consecutive years, highlighting their strategic importance. Now that promise is turning into reality.

Digital twin implementations are set to increase by 36% over the next 5 years, according to a report by the Capgemini Research Institute. That study found that organizations adopt digital twin technology primarily to reduce time to market (73%), save costs (79%), and improve operational efficiency (71%).

Market research indicates that 62% of companies see immense value in digital twin technology, with 92% reporting at least 10% ROI from implementation, according to Hexagon. As the impact increases, the digital twin simulation market is projected to grow from $15 billion in 2023 to $173 billion by 2030, with the US representing about 35% of the market, according to Fortune Business insights.

Key industries driving adoption include manufacturing (24%), automotive (21%), energy and utilities (12%), and healthcare (9%), according to Revaia analysis.

Industry Applications and Case Studies

Digital twins are finding applications across numerous sectors:

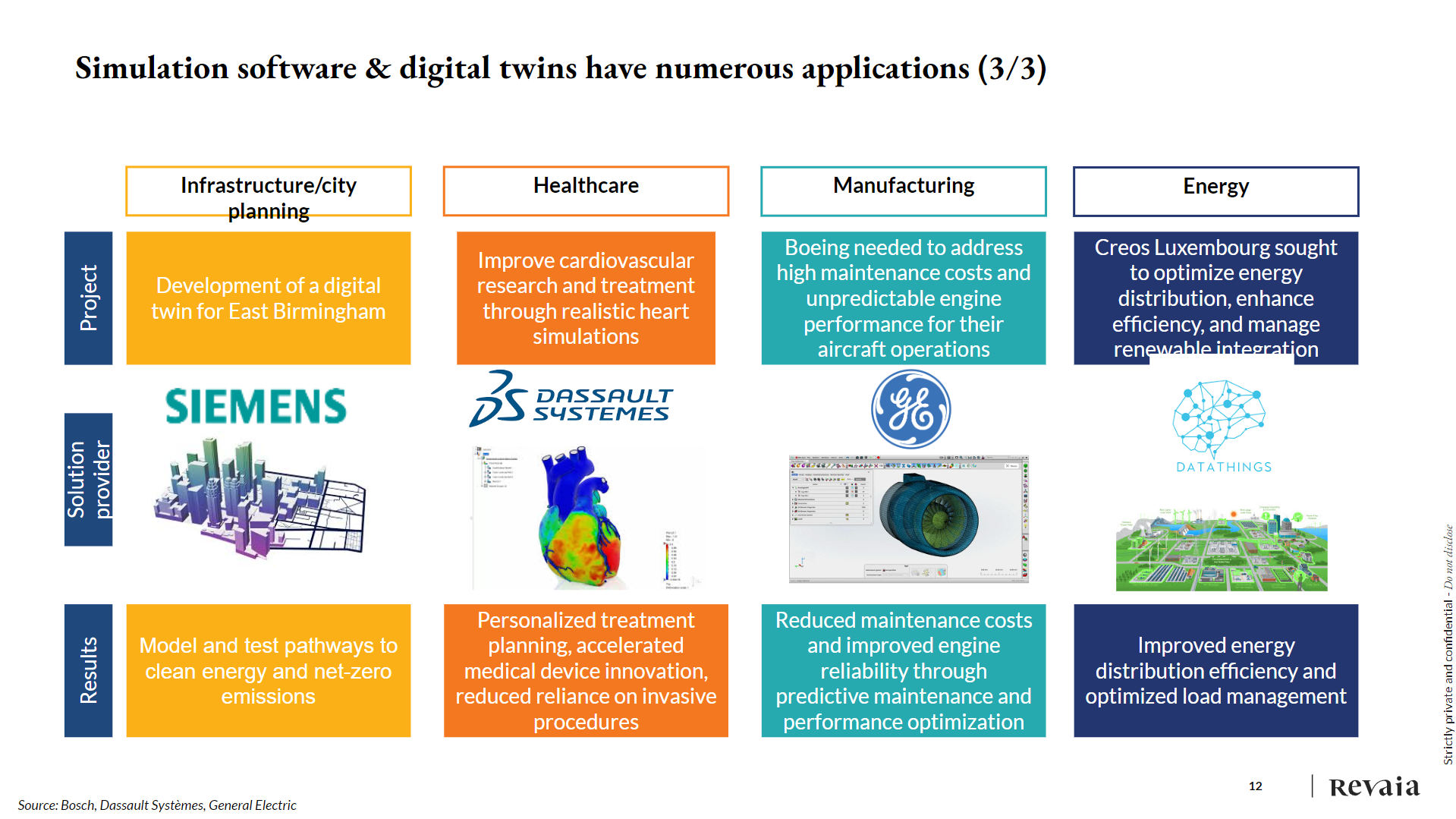

Healthcare: Johnson & Johnson uses digital twins extensively across their organization, from clinical trials and drug discovery to medical device research and go-to-market strategies. Startups like in HEART are developing heart digital twins for cardiac interventions, while others like Virtonomy.io focus on virtual medical trials.

Manufacturing: Companies like Boeing have reduced maintenance costs and improved engine reliability through predictive maintenance and performance optimization. NavVis and ONIQ are developing factory digital twins for lean manufacturing and process optimization.

Energy: Entities like Creos Luxembourg are optimizing energy distribution and managing renewable integration. Startups like Akselos (structural digital twins), Gradyent (digital twins for electrical grids), and Climate X (digital twin of Earth for climate risk assessment) are advancing digital twin technologies.

Infrastructure/City Planning: Projects like East Birmingham's digital twin help model and test pathways to clean energy and net-zero emissions.

Market Landscape

The simulation software market is highly concentrated, dominated by 40+ year-old European companies that invest heavily in R&D. The "EU Big 4" includes:

- Siemens: €178 billion market cap, €78 billion in revenue (FY23)

- Schneider Electric: €129 billion market cap, €39 billion in revenue

- Dassault Systèmes: €49 billion market cap, €6 billion in revenue

- Hexagon: €26 billion market cap, €6 billion in revenue

These industry leaders typically spend 20-35% of their revenue on R&D, with Altair Engineering and Synopsys leading at 35% and 33%, respectively.

Other significant players include Ansys (recently acquired by Synopsys for $35 billion), Autodesk, PTC, and Rockwell Automation. Big Tech companies like Microsoft (Azure Digital Twin), AWS (IoT TwinMaker), Nvidia (Omniverse), and IBM (Watson IoT) have also entered the space.

Many of those incumbents are quietly building software conglomerates through M&A. Siemens alone has led or participated in $60 billion worth of acquisitions. Revaia’s analysis shows that nearly all major simulation and digital twin players—Ansys, Autodesk, Dassault Systèmes—have embraced a buy-to-expand strategy.

Investment Opportunities

It's no surprise, then, that venture capital and corporate M&A are heating up. Over $60/$16 billion in US/European acquisitions have taken place in the past four years, with acquired companies fetching premium multiples, averaging 7/8x revenue.

Despite the dominance of established players, there's a vibrant startup ecosystem with approximately 30+ companies in Europe developing innovative solutions.

The venture capital landscape shows promising activity, with recent notable rounds including:

- Bright Machines: $126 million Series C (June 2024)

- Twin Health: $151 million Series C (December 2021)

- Cognite: $150 million Series B (May 2021)

- Rescale: $100 million Series C (November 2021)

In Europe, investments have been more modest but diverse, spanning cloud systems, physics simulations, healthcare applications, and energy optimization solutions.

Still, startups face a challenging competitive landscape, sandwiched between incumbents and Big Tech. For startups, this means two things. First, you don’t want to compete on breadth. The smart play is to specialize—either by vertical (like cardiac twins in healthcare) or by capability (like AI-powered data integration). Second, M&A is a realistic and highly attractive exit path, especially if you can solve a niche problem better than a generalist.

Investment Outlook

Simulation software and digital twins remain underpopulated startup markets with big growth potential. There are opportunities in digital twins for healthcare, decision-making, and consumer behaviors, for example.

Despite all the activity and advances, these technologies are still in their early days. That means that simulation software and the digital twin market represent a dynamic and rapidly evolving space with significant potential for investors.

In a world where foresight is power, simulation software and digital twins are fast becoming the compass for modern enterprises. Those who learn to read them well will be the ones charting the future. Those who build them will enable a new generation of innovative business models.