Revaia's Climate Guide: A Pragmatic Approach for VC and Growth Investors

With the fight against climate change more urgent than ever, VCs and Growth investors have an important role to play.

However, aligning investment strategies with global climate goals demands a carefully calibrated approach that balances returns and decarbonization efforts.

Climate change has been a key theme for Revaia since our founding more than five years ago, and we know that navigating the tradeoffs can be complex. That’s why our firm has developed a comprehensive Climate Guide to help investors learn about the frameworks and tools that can help their portfolio companies meet ambitious climate targets while still recognizing the financial realities of VC and growth investing.

The report focuses on investors because they are in a unique position to influence the business practices and models of their portfolio companies from the earliest stages. By integrating climate considerations into their overall strategy, investors can help ensure that these companies are setting climate goals from the outset.

The guide includes an introduction to key climate change terminology, results of a survey among main European investors to understand the current state of the art of decarbonization, evaluations of the major decarbonization frameworks, and practical advice on how to implement strategies. While the guide is primarily aimed at investors, its principles can also be used to engage with founders who may be skeptical about the need for decarbonization.

Now is the time

Growth investing and fighting climate change can coexist. The importance of striking that balance can not be overstated: Global emissions need to be reduced by approximately 50% each year to avoid catastrophic climate impacts.

If averting a climate catastrophe is not sufficient motivation, then consider that a wider range of regulatory requirements are coming into effect in different countries and regions around the world. Companies will have to know these rules and how to comply with them.

In addition, LPs are increasingly focused on this topic, and are therefore holding accountable the funds they back. These demands are simply smart investment strategy. They want to make sure the assets where their money is invested are compliant with regulations and future proof, both of which are elements of resilient companies that are built for the economy of tomorrow.

And yet, we are releasing this guide just as the tech economy stands at a delicate crossroads. After playing a key leadership role over the past decade by adopting decarbonization goals, this momentum is being challenged by the rapid adoption of AI. In recent months, some major cloud companies have publicly acknowledged missing their climate goals as demands for processing power and data center usage are driving higher energy consumption.

To be clear, AI is not necessarily the enemy of decarbonization. There are also many AI-driven tools that can create efficiencies that offset carbon emissions. It’s important to recognize that these tools can be enablers in the fight against climate change.

Still, it can be difficult to see how all the pieces of this puzzle can fit together. This is where we think the Guide can help.

The genesis

The idea for the guide was sparked when a Limited Partner challenged Revaia to align our investment strategy with the Paris Agreement. While Revaia already had a climate strategy in place, this call inspired us to explore how we could formalize and certify our approach with science-based targets.

The journey was far from straightforward.

Existing frameworks, like the Science-Based Targets initiative (SBTi), were not fully compatible with the unique nature of growth investing. That’s because such traditional climate pathways focus on absolute emission reductions – a goal that is often incompatible with the growth trajectories of startups and scale-ups.

But if a linear reduction in emissions is unrealistic for both our firm and our portfolio companies…then what? There was no obvious answer that specifically helps investors navigate these tradeoffs without compromising on their growth objectives.

This realization led to months of research. The development of the guide was shaped by a survey of 32 European VC and growth investment firms. One of the surprising findings was that 22% of these firms had a formalized climate strategy. While this may seem like a small percentage, it indicates a growing awareness and commitment within the industry.

The survey also highlighted the obstacles that investors face and the reasons so many have still not adopted a climate change strategy. The common problems cited were lack of data and knowledge, the relative immaturity of most portfolio companies, the complexity of scientific frameworks, and lack of resources.

These are all legitimate issues. But they are not insurmountable.

Step by step

Reconciling growth with emission reductions may seem like an overwhelming task. That’s why the guide seeks to lower the barrier for getting started by breaking it down into pragmatic steps to help investors develop a practical yet robust climate strategy for their portfolio companies.

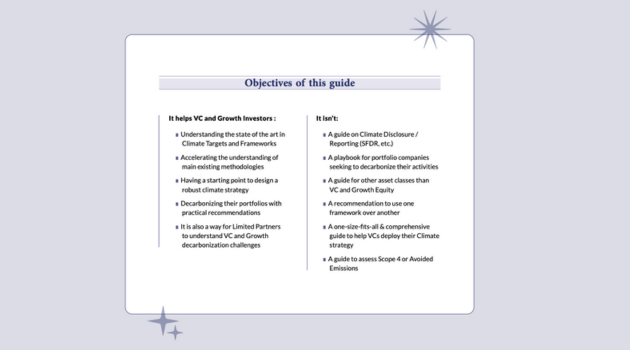

We identified several key objectives:

1. Accelerating Understanding: The guide serves as a state-of-the-art resource on climate targets and frameworks by educating VC and growth investors about existing methodologies and how they can be applied in the context of high-growth companies.

2. Practical Recommendations: To help their portfolio companies decarbonize effectively the guide has tips that are grounded in the realities of the VC and growth investing landscape, ensuring that they are both actionable and relevant.

3. Investor-Focused: While the guide offers insights into the broader challenges of decarbonization, its primary focus is on the needs of investors and how they can work with their portfolio companies.

4. Addressing Framework Gaps: The guide also highlights the limitations of existing frameworks and offers solutions tailored to the specific needs of VC and growth investors.

Navigating frameworks

After providing an introduction to key climate change terminology, the guide gives a detailed analysis of the existing climate frameworks. Revaia evaluates several major frameworks, including the Science-Based Targets initiative (SBTi), the Net Zero Investment Framework (NZIF), and the emerging Venture Climate Alliance.

There is no single right framework, no one-size-fits all. Each of these frameworks offers different benefits and limitations, and the guide evaluates the strengths and limitations to help investors choose the one that best fits their needs.

For instance, SBTi is recognized as the definitive standard for aligning with science-based climate goals. Yet it can be complex and may not fully accommodate the rapid growth and expansion typical of VC-backed companies. The guide suggests that investors consider using a combination of frameworks or adapting existing ones to better fit their specific investment profiles.

From there, the guide outlines clear recommendations for getting started:

1. Reliable Data Collection: This is essential for understanding the carbon footprint of portfolio companies. The guide emphasizes the importance of gathering comprehensive emissions data and explains methodologies for estimating carbon footprints, even when direct data is not available.

2. Target Setting: The guide offers advice on how to establish both short-term and long-term targets that reconcile the overall growth strategy of the portfolio companies.

3. Supporting Portfolio Companies: The step-by-step process for helping portfolio companies develop and implement their decarbonization roadmaps includes practical strategies for engaging with portfolio companies, offering support for carbon accounting, and fostering a culture of sustainability within these organizations.

4. Capital Allocation Strategies: This involves not only investing in companies that are already embracing these goals but also supporting existing portfolio companies in their efforts to decarbonize.

Even with this guide, we know that taking those first steps can be daunting. And many actors – investors and founders – will still wonder if what they are doing will really make an impact on the broader climate change fight.

So let’s clear: Every action counts in the fight against climate change. And some more than others. One of the best ways to optimize a new strategy is to identify potentially high-impact actions, even if they are challenging to implement.

That may mean engaging with your supply chain, discussing with your cloud provider, or rewriting code to make it more efficient. Follow the 80/20 rule: the right handful of actions can deliver the most payoff.

Shaping tomorrow

By focusing on what truly matters and leveraging their unique position, investors can play a pivotal role in creating a sustainable future. While this can often feel like a defensive posture, we encourage everyone to see that investing in climate-positive solutions or decarbonization enablers represent a vast opportunity in terms of finance and impact.

This guide offers a clear roadmap for helping investors not only meet regulatory and stakeholder expectations but also contribute to a more sustainable future. Learning to align these types of goals will only become more urgent as humanity confronts other accelerating problems such as biodiversity loss, deforestation, and ocean acidification.

Accepting this responsibility is the right thing to do for investors to ensure a sustainable future for generations to come. A healthy and safe planet is good for people – and good for the economy. It’s time to move past the debate about tradeoffs and sacrifices and move forward with a pragmatic and robust approach that aligns investing and mitigating climate change.