Revaia's 2023 ESG Report Spotlights Diversity Progress – and Challenges

Revaia’s core mission from the start has been to champion sustainable leaders in technology and innovation.

We believe startups that share our values regarding the environment, social responsibility, and strong governance can positively impact and scale to become global successes.

That belief has to be more than just words. As we often say, you can’t change what you can’t measure. In that spirit, we’ve released Revaia's 2023 ESG Report, our annual comprehensive overview of the firm's efforts and progress toward these critical goals, both internally within the firm and externally with our portfolio companies.

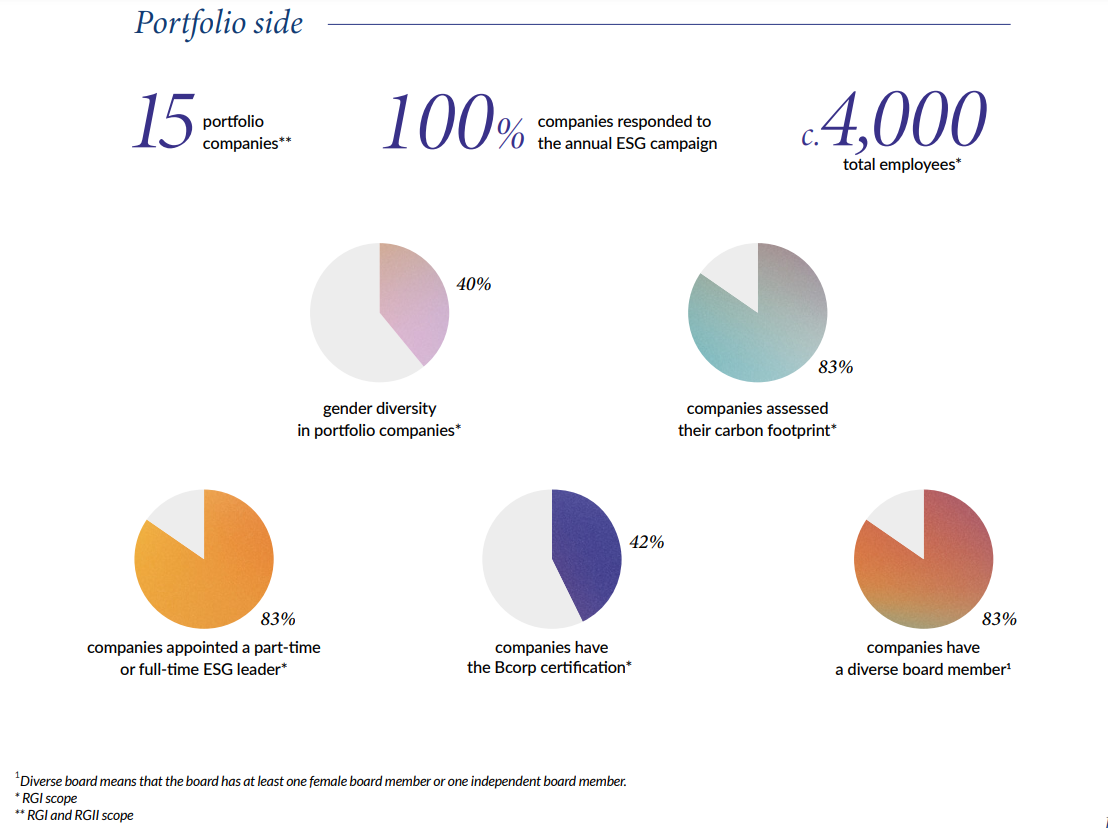

Revaia has an ESG impact on three levels: the European ecosystem, our firm’s practices, and our portfolio companies. In this report, we offer insight into all three categories, including measuring across 50 criteria how far those 15 portfolio companies have come since we first invested.

While these are long-term strategies, we are particularly proud that most of these metrics have moved in a positive direction. We have been particularly impressed that our portfolio companies have continued to make these goals a priority even during a challenging economy when they face greater pressure to focus on their financial bottom line.

That resilience is even more evident when we zoom in on diversity. While headcount is getting more scrutiny than ever, our portfolio’s commitment to addressing this challenge kept most of these metrics moving in the right direction.

Key Takeaways

Our 64-page ESG report covers a wide range of metrics from our firm and our portfolio companies. For Revaia, we highlighted several important milestones in 2023:

- We developed the first European ESG Data Benchmark for startups which provides KPIs based on the maturity stage of tech companies.

-

Revaia achieved B Corp certification with a score of 96.2.

-

Our work was recognized by being chosen for the prestigious SWEN Capital Partners ESG Best Practices Honors in the category of Private Equity.

-

Revaia Growth II fund received the LuxFLAG ESG label for its commitment to ESG principles.

Our portfolio companies also made progress. We certainly don’t take all the credit for this work. But we believe the impact of our values and strategies can be seen in several key metrics:

- 83% of companies in Revaia Growth I now have an ESG leader, a role that we found in our Benchmark Survey that plays an essential part in keeping companies’ ESG plans on track.

-

83% of both funds have assessed their carbon footprints, up from 20% in 2021.

-

100% are implementing carbon education initiatives, up from 60% in 2021.

-

42% now have the B-corp certification

-

100% of companies in Revaia Growth I have implemented an employee shareholding program.

Zoom on diversity

Looking at the big picture, our portfolio companies now employ more than 4,200 people. That number increased by 427 in 2023, a net gain despite a context where many companies are downsizing to accelerate toward profitability. Indeed, the churn rate across our portfolio was 25% in 2023, hinting at the challenges founders are facing in terms of retaining talent and managing the bottom line.

Amid this turbulence, companies in our first fund have maintained a workforce that is 40% women – roughly flat from the past two years. This overall ratio is consistent with the European benchmark of 39% reported by Equileap’s technology sector sample workforce.

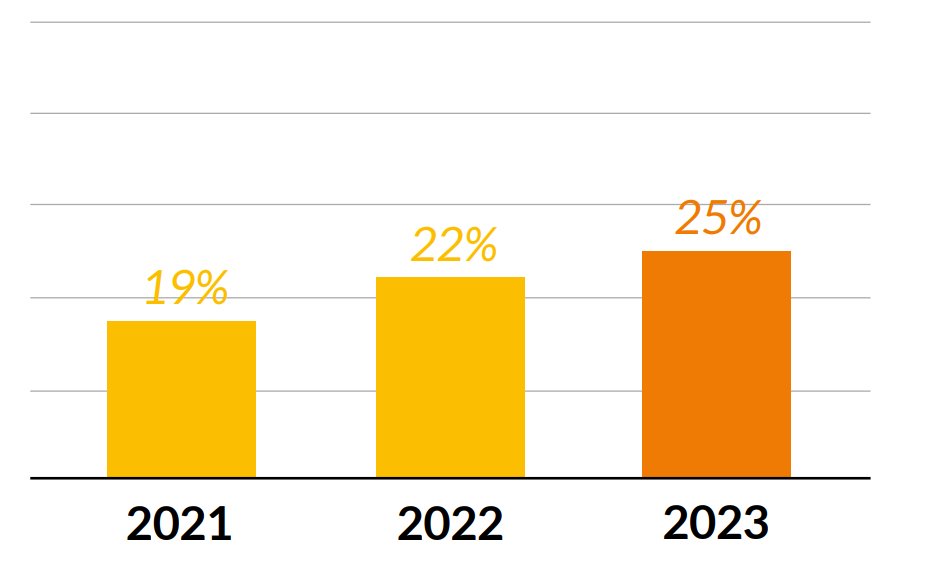

Even better, within our first fund, IT jobs are now 25% women, up from 19% in 2021. This ratio is above the benchmarks of 21% in France and 20% in Europe.

source: Women in Digital Scoreboard 2022, Digital Economy and Society Index

So, despite reductions in some companies and the churn rate, more than half of Revaia’s companies increased their overall workforce diversity. That push to hire more women for technical jobs was one of several factors that helped reduce the unadjusted gender pay gap to 11%, down from 13.6% in 2021.

How Revaia helps

Revaia continues to drive diversity improvements through several key initiatives:

Gender Diversity Charters: We encourage portfolio companies to adopt formal gender diversity charters to maintain focus on equitable practices. Sometimes founders will push back and wonder why they need it. We have found that it’s important to document your practices and make the commitment clear so that such goals are not cast aside during difficult moments. As of 2023, 83% of portfolio companies have implemented a diversity charter.

Recruiting: We actively share profiles with our companies, especially at the C-level. And we have built a network among those companies, a Slack channel so they can support each other in finding the right candidates.

Training and Development: During stressful times, it can be easy to forget best practices. That’s why we seek to reinforce those values by promoting training programs on diversity and inclusion. We connect companies with advisors to enhance their development and ask them to report what kinds of training they have done.

Gender Pay Gap Reduction: This is something that has to be done proactively. Companies can’t just wait and see and hope it will improve. We support companies actively addressing and reducing the gender pay gap through structured internal processes that promote women into higher-paying roles. As part of the diversity charter, companies also assess their gender pay gap. 100% of our first fund’s portfolio companies now assess their unadjusted gender pay gap.

Looking back on 2023, we can see the efforts we have been making during our first 5 years bearing fruit. While we want to celebrate this progress, we intend to build on this momentum to continue closing those gaps and building the economy of tomorrow that is both innovative and inclusive.