Planisware's ESG Strategy: A Blueprint for Aligning Sustainability and IPOs

By Bettina Denis

As investors increasingly prioritize sustainability, companies across industries are integrating Environmental, Social, and Governance (ESG) strategies into their core operations to match these expectations.

While there is an ongoing debate about the role of ESG in setting valuation and achieving successful exits (see our article here), Revaia considers this to be a critical component for maximizing valuation. To that end, the recent IPO of Planisware, a leading French project management software company, is a compelling example of this trend.

Planisware went public on April 18, 2024. Its IPO valued the company at €1.11 billion making it the largest such publicly traded debut on the Euronext Paris stock exchange in the last three years. The stock closed at €20.09 per share on the first day of trading and has climbed to €31.20 (as of August 16).

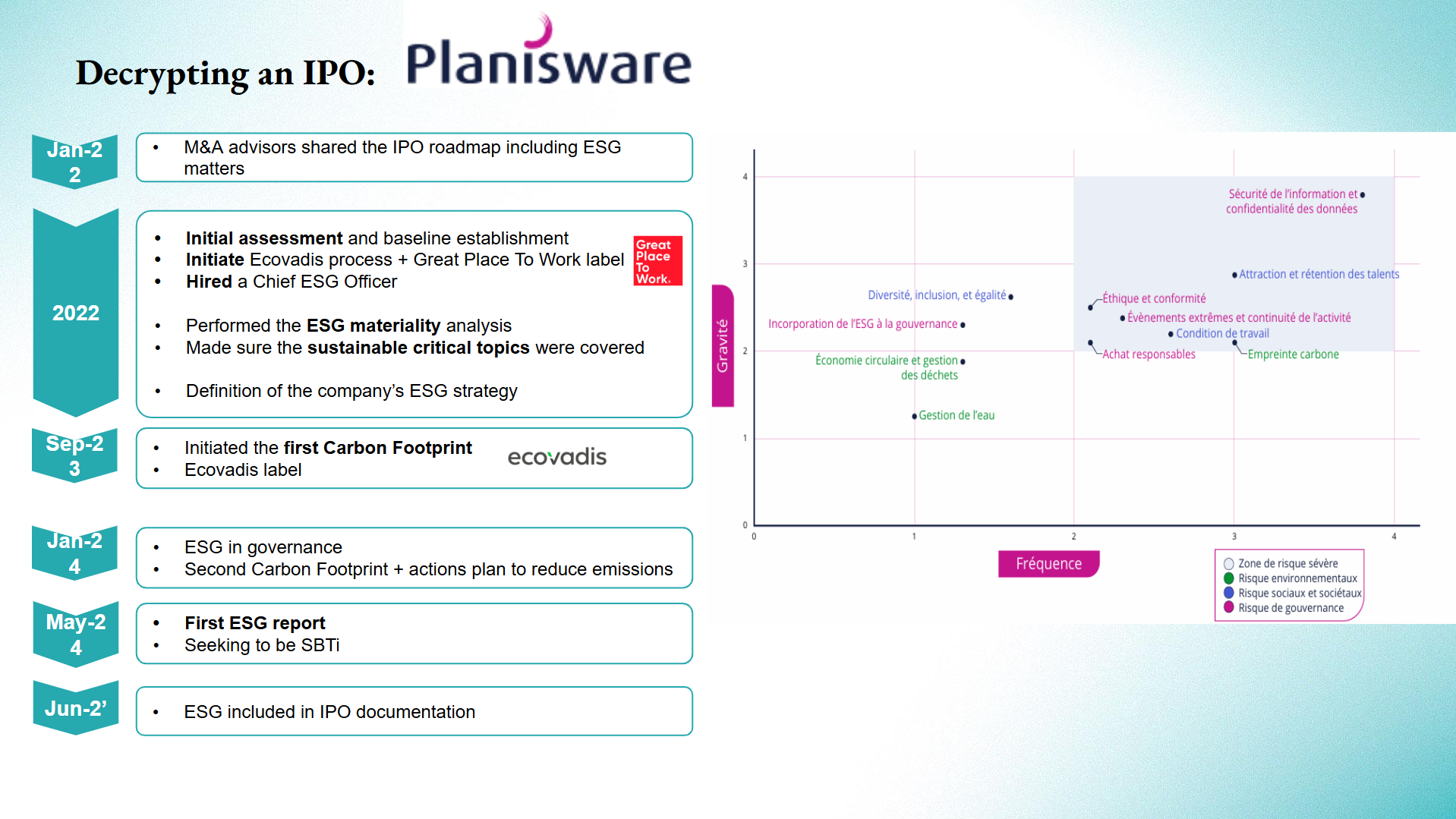

What makes Planisware an interesting ESG case study is that the company had originally planned to go public in 2023 but decided to wait due to market conditions. When executives chose to move forward this year, they updated their IPO filings and greatly expanded disclosures related to ESG.

The ESG strategy was not just a footnote in their IPO; it was a central theme that underscored Planisware’s commitment to responsible business practices and sustainable growth, making it a cornerstone of their successful market entry.

Comparing the two versions of Planisware’s IPO filings offers lessons on how the company’s ESG policy evolved and the role it played in the exit.

The company

Planisware is a project management company that was founded in 1996. More recently, the company’s shift to a SaaS model has accelerated growth, including double digital YoY revenue increases while also being profitable.

With strong momentum, the company was hoping for an IPO in October 2023. The filings in September 2023 characterized its ESG commitments as aspirational, with phrases like "we began implementing" and "we intend to focus" featuring prominently. Planisware “intended” to set up a strategic energy committee. Planisware noted that it had received the “Great Place to Work” certification for “maintaining and strengthening its caring company culture and providing a stimulating and collaborative working environment.”

Reading that first version, it would appear that the company hadn’t done much in terms of ESG. But executives made it clear that they did plan to do plenty of things. They were very transparent about where they were and what they wanted to do, which committed them to doing it by disclosing the plans in public.

Flash forward to the 2024 filing, and it’s a different story. The ESG section runs for three pages and uses terms like “we began implementing.” By the time of the IPO, these commitments had evolved into tangible achievements, such as completed carbon footprint assessments, implemented company-wide ESG measures, and published extra-financial reports. This second filing showcased completed initiatives and measurable outcomes such as implementing a charter with suppliers and publishing their first ESG report.

How did the company make so much progress in such a short time?

It turns out that Planisware’s ESG efforts had begun several years earlier, but executives had been reluctant to discuss this strategy during their Summer 2023 roadshow because they lacked concrete results.

In fact, executives had decided to position the company as a leader in sustainable practices with a focus on aligning the company’s operations with the highest standards of environmental responsibility, social governance, and ethical business practices.

The company began laying the groundwork in 2022 through careful planning and strategic initiatives, which started with the announcement of its Great Place To Work certification alongside data certifications. To ensure that its ESG efforts were aligned with its business strategy, Planisware conducted a materiality analysis, which outcome emphasized key areas such as data security, talent retention, carbon footprint reduction, and responsible sourcing.

From there, Planisware had an initial ESG assessment by EcoVadis (Silver Medal) which established clear baselines for its environmental and social impact.

As the ESG strategy evolved and implementation expanded, Planisware’s transparency and commitment were crucial in building investor confidence.

Key Elements of Planisware’s ESG Strategy

Planisware’s ESG strategy offers valuable lessons for other companies:

1. Governance and Diversity: Recognizing the importance of leadership in driving ESG initiatives, Planisware emphasized diversity and governance as critical components of its strategy. The company’s board of directors was restructured to include greater gender diversity, with three out of seven members being women and three independent board members. This move aligns with broader trends in corporate governance, where diversity and independence are increasingly seen as indicators of strong leadership.

2. Data Security: In an industry where data security is paramount, Planisware made it a top priority. The company ensured that 100% of its employees were trained annually on data security best practices and obtained numerous business processes certifications including ISO27001, SOC2 TYPE2 and TISAX Level 3, demonstrating a commitment to protecting customer and employee information. This focus on data security not only mitigates risks but also enhances the company’s reputation and trustworthiness in the eyes of investors and clients.

3. Carbon Footprint and Environmental Impact: Planisware’s commitment to reducing its environmental impact is evident in its proactive approach to carbon footprint management. The company conducted two carbon footprint assessments, refining its methodology over time to ensure accuracy and effectiveness. This data-driven approach allowed Planisware to implement company-wide measures aimed at reducing emissions, aligning with global efforts to combat climate change.

4. Talent Attractiveness and Retention: The company also prioritized social aspects, particularly in terms of talent management. Planisware leveraged its Great Place to Work certification to attract and retain top talent, recognizing that a motivated and engaged workforce is essential for long-term success. The introduction of Long-Term Incentive Plans (LTIPs) further demonstrated the company’s commitment to aligning employee interests with its long-term ESG goals.

5. Supplier Responsibility: Responsible sourcing was another key focus area, with Planisware implementing a supplier charter that required suppliers to meet specific ESG criteria. This move ensured that the company’s sustainability efforts extended beyond its operations, influencing its entire supply chain.

Impact of ESG on Planisware’s IPO

In a world where investors and consumers alike are increasingly demanding responsible business practices, Planisware’s approach to ESG serves as a blueprint for how businesses can effectively integrate sustainability into their operations and create long-term value for both shareholders and society at large.

The company’s experience demonstrates the importance of starting early, the value of transparency and regular reporting, and the importance of integrating ESG into the core business strategy, rather than treating it as a separate initiative.

In our view, Planisware’s ESG strategy not only contributed to its successful IPO but also positioned the company as a leader in sustainable business practices. We believe the company has created a solid foundation for long-term growth and resilience well beyond its exit in an increasingly sustainability-conscious market.

Disclosure: Assumptions presented in this document are based solely on publicly available sources and do not include any proprietary or confidential information.