Energy Management Software: A Critical Tool for the Clean Energy Transition

Energy management software (EMS) has emerged as a crucial technology sector as companies and utilities grapple with the complex challenges of transitioning to clean energy while managing increasingly volatile energy costs.

As demand for energy soars, governments and companies are massively investing in the infrastructure to produce and distribute more power, creating a grid that is larger and more complex to manage. This is where EMS has the potential to create tremendous value through innovations that address these challenges.

Climate has been part of the core investment thesis at Revaia from the start. So our team recently took a Deep Dive into the EMS sector to better understand the underlying dynamics. We want to share some of the key insights because supporting innovation in energy and climate tech is taking on greater urgency in the race against climate change.

Market Evolution

Three major macro trends are reshaping the energy sector.

- Global energy demand continues to rise due to population growth and increasing electrification. With growth of almost 4x over a century, the world population will inevitably increase energy consumption. Total global energy consumption is projected to increase steadily through 2050 to reach almost 800 exajoules. The share of clean energy in total consumption is expected to become dominant with renewable energy sources projected to see the most significant growth.

- Energy prices have become highly volatile due to geopolitical events like the Ukraine war. Significant spikes in energy prices correspond with major geopolitical events, such as the Russian invasion of Ukraine and the COVID-19 pandemic, highlighting the sensitivity of the energy market to global tensions. There is a critical need for robust energy policies to mitigate the impact of global political developments on energy prices.

- Climate change is forcing a fundamental transformation of energy systems while also putting new strains on infrastructure. In the EU, energy use represented the majority of the EU’s GHG emissions in 2022. Energy use emissions are driven by the Energy industry itself (27.4%) and by the transportation sector (23.8%), according to a European Parliament report.

These forces are driving investment into the sector. Global energy investments will grow by 35%-120% from 2021 to 2040, with renewable energy and decarbonization technologies accounting for the largest share of the growth, according to McKinsey and the European Investment Bank. Oil & Gas will see their share of investment decline gradually over time.

Amid this transformation, there are a couple of key priorities. GHG emissions need to be limited at a global scale. Adoption of clean energy needs to accelerate, a trend that should be boosted as such sources become more accessible thanks to declining prices.

Much of this investment, of course, must go into hardware and physical infrastructure. But software is a key ingredient for maximizing the value of these assets.

The Software Opportunity

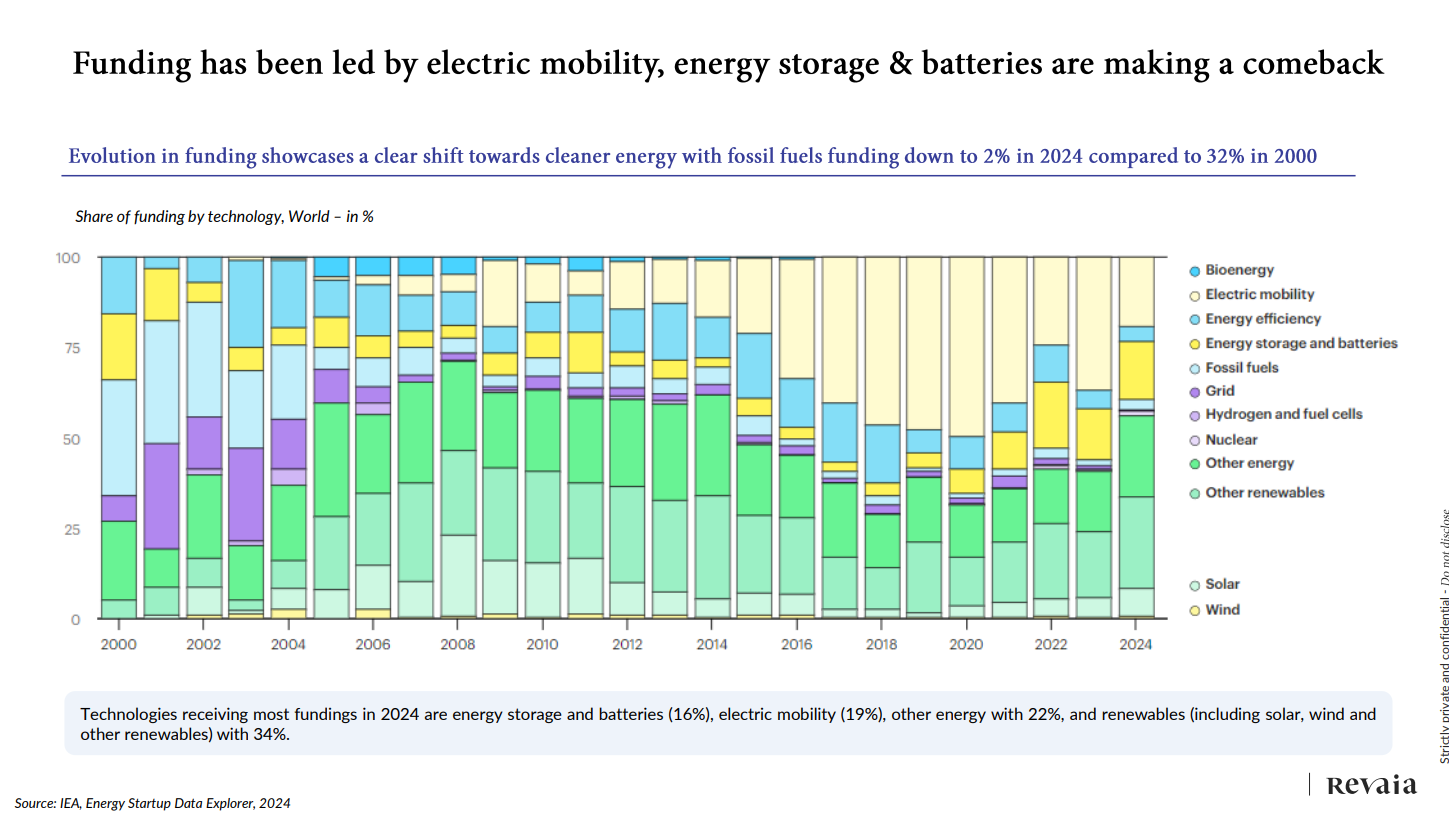

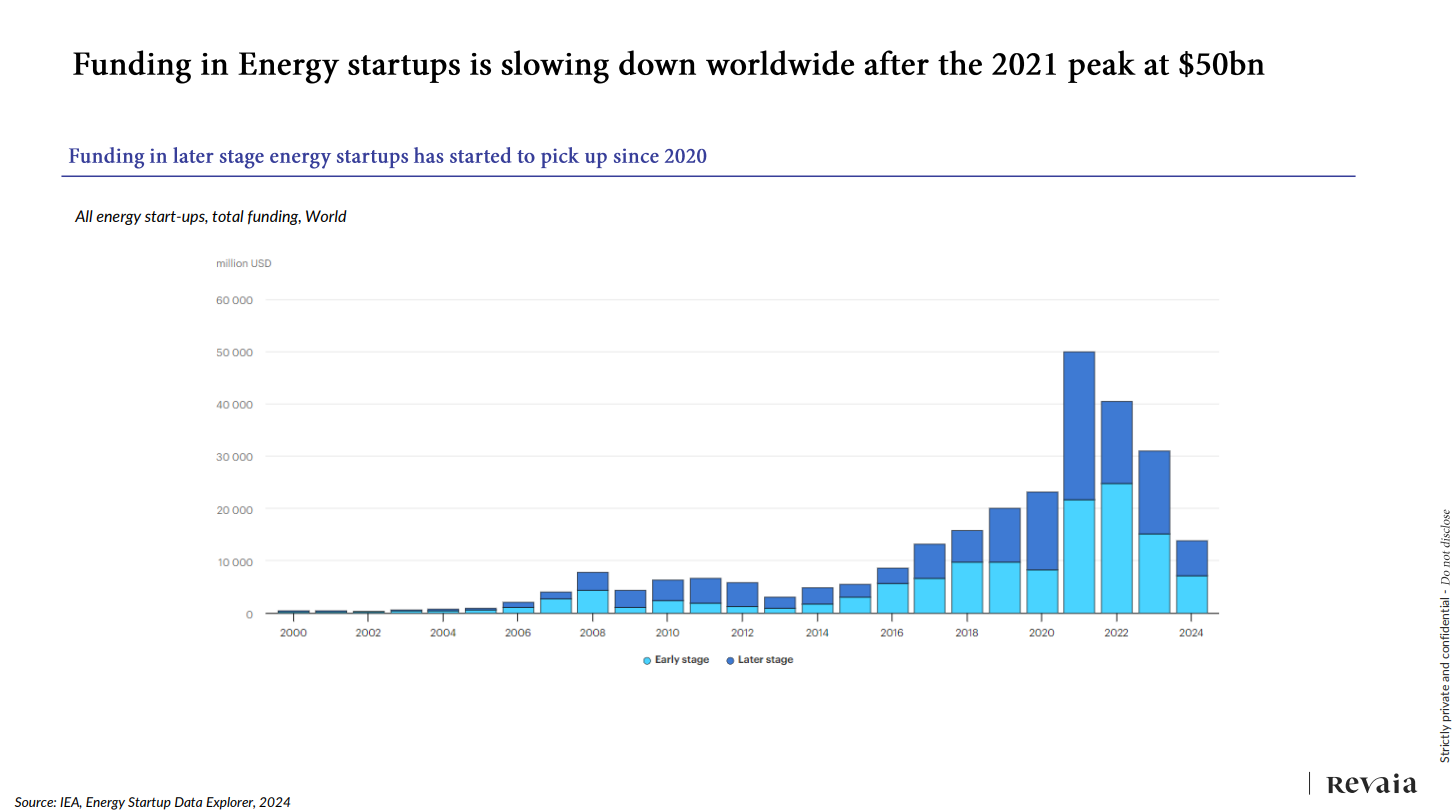

Energy was the most funded segment in climate tech in 2023, attracting $40.9 billion globally, according to Net Zero Insights. Technologies receiving the most funding in 2024 included renewables (including solar, wind, and other renewables) at 34%, electric mobility (19%), energy storage and batteries (16%), and other energy at 22% according to the IEA and the Energy Startup Data Explorer.

In Europe, energy has been the top VC investment sector for four consecutive quarters, outpacing traditional favorites like fintech, healthcare, and enterprise software. The energy sector attracted $3.1bn in Q1 2024, according to Dealroom.

While funding toward hardware companies has accounted for a large portion of this surge (think Verkor or Northvolt), the phenomenon extends well beyond this base. In 2022, there were 1,200 digital energy startups created across sectors such as IT systems, software, mobile applications, social media, networking, machine learning, and the Internet of Things.

EMS is emerging to help solve critical challenges across the entire energy value chain, from generation to consumption. These solutions help utilities and businesses optimize energy usage, integrate renewable sources, enable predictive maintenance, enable smart grids, and reduce emissions.

Despite this potential, funding for energy’s software segment is lagging compared to hardware.

Most funding for EMS companies comes at the very earliest stages, often through incubators and accelerators. Corporate venture capital (CVC) arms also play a prominent role in the EMS space.

Likewise, the M&A market is primarily driven by large energy and industrial companies looking to acquire innovation. Most acquisitions happen relatively early in a company's lifecycle. Energy giants like Shell and BP are hunting for small to mid-sized players, typically around the series A or B stage.

Key Challenges

Despite the sector's promise, several significant challenges need to be addressed:

Scalability Issues: Some innovations, like Virtual Power Plants – a network of decentralized, medium-scale power generating units – look cool on paper but take time to scale.

Market Size Limitations: While certain technologies show great promise, their Total Addressable Markets (TAM) may currently be too small to support venture-scale returns. For instance, batteries are very promising, but TAM for this technology is very limited right now.

Infrastructure Dependencies: Many innovations rely on upgrading aging energy infrastructure, which can slow adoption. The European Union alone needs to invest €584 billion to upgrade its power grids to support the clean energy transition, according to Sifted.

Early-Stage Competition: Lots of duplication. Startups need clear differentiation strategies.

The Outlook

The race is on to build the operating system for our clean energy future. As the global energy landscape undergoes its most dramatic transformation in a century, EMS stands at the crossroads of several trends that position it to play a vital role.

Traditional energy giants are actively hunting for software solutions to help them manage an increasingly complex and decentralized energy future. This will require the creation of an intelligent layer of software that will connect, optimize, and orchestrate these resources.

For investors, the key is finding EMS companies with approaches and business models that can successfully scale to meet this growing opportunity while building sustainable competitive advantages. The companies that can solve these challenges at scale won't just capture financial returns – they'll enable one of the most important technological transformations of our time.