Crossover Investors in Europe: Progress and challenges for innovation financing

We founded Revaia more than 5 years ago, in part, to address the Growth Equity gap facing European startups.

While great strides have been made in providing early-stage capital, the most successful startups in Europe need more robust financing to realize the potential of transformative ideas.

Whether that takes the form of an IPO, acquisition, or investment to remain independent, startups must be sufficiently capitalized to continue their journey through their late stages and beyond. Among the many building blocks that need to be put in place are Crossover Investors – firms that can invest in the private and public markets.

To bring greater attention to this topic, Revaia published its inaugural report last year, “The Path To IPO.” While Crossover Investing surged in Europe and transformed late-stage funding, we can now clearly say that the world experienced record investment years in 2020 and 2021. While the investment pace has slowed since then, it still is growing compared to its pre-2020 levels.

In the wake of this shift, we have published the second edition of our report to review the state of Crossover Investing in Europe through 2023 to see what lessons it might reveal. You can read the full report here.

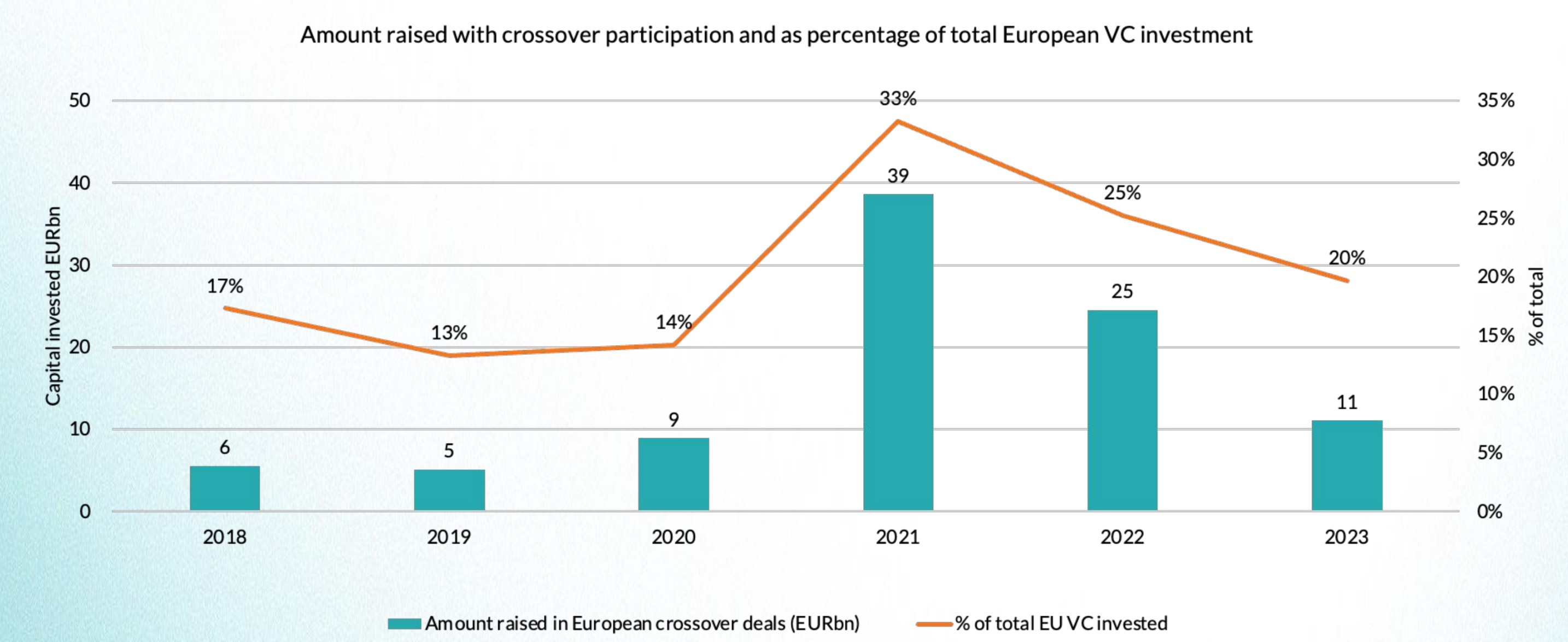

The data shows that Crossover Investors participated in European equity rounds totaling €11 billion in 2023 – a sharp drop from €39 billion in 2021. That surge in 2021 was caused primarily by a handful of non-European Crossover Investors that made it appear as though some of the Growth Equity challenges had been solved, or at least improved. The retreat of 4 of these global players accounts for most of the subsequent drop in Crossover Investment activity.

Revaia Crossover report

However, the good news is that despite the turbulence of the last two years, Europe’s homegrown Crossover sector remains stronger than it was before the investment surge of 2020-21. Crossover Investors were present in 20% of all funding rounds in 2023, showing resilience in the face of market volatility. Indeed, 2023 figures for Crossover Investing in Europe are more than double those of 2019, indicating a long-term growth trend despite short-term fluctuations.

To build on this momentum, we must redouble efforts to put in place all the necessary pieces for the innovation journey, from the very earliest moments of startup inception through all of the stages of scaling, and finally to robust exits that sustain the very best companies while providing the liquidity needed for investors to make this cycle larger and faster. This all must be done while holding fast to the values that guide us.

We want to recognize that beyond facts and figures, there continues to be an immense amount of unheralded qualitative work being done to forge strong relationships between founders and investors to educate each side about what is needed for a company to successfully continue its scaling journey.

As we survey the landscape of innovation actors, we are heartened by the unwavering commitment of partners such as Bpifrance, Euronext, and Deutsche Börse, to do the hard, unsung labor in the trenches required for the European ecosystem to fulfill its promise. They understand this will be a long-term effort.

At Revaia, we are proud to do our part in this collective effort as we work together to build the European economy of tomorrow.