Breaking Down GenAI Investment Opportunities

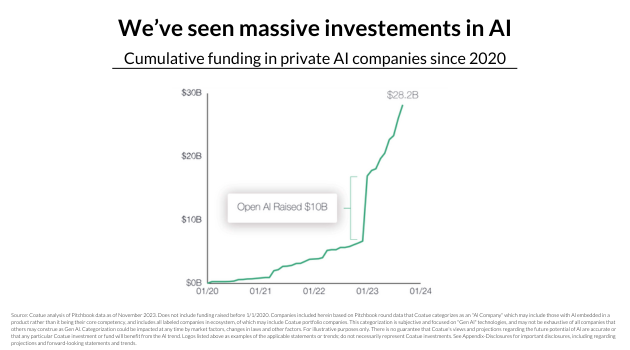

GenAI has turned the tech investment world upside down over the past 18 months. While investors remain very selective about many startup sectors that were red hot just a couple of years ago, they are pouring money into GenAI startups at a remarkable clip.

The divergence between fundraising for GenAI and non-GenAI startups is stark. According to CB Insights, global funding for AI startups fell 10% in 2023 from the previous year, much smaller than the overall 42% drop in startup funding. Of that AI funding, 48% went to GenAI startups.

As everyone rushes into this new sector, it inevitably raises questions about where to find the real value and opportunities amid the chaos. Stories of early-stage GenAI companies that haven’t even released a product raising rounds at unicorn valuations tend to scare off many investors with price tags for deals that raise fears of a bubble in this sector.

But not all GenAI opportunities are alike. As our team at Revaia looks under the hood of the GenAI market, we see 5 major categories that offer different possible investment scenarios.

The Big Picture

First, let’s take a step back and understand the larger context. It’s not unreasonable to wonder how much of the GenAI frenzy is true transformation and how much is just hype. Is the current GenAI climate optimism or delusion?

There is a strong case to be made that it’s the former. There is even a good argument that the transformation potential for GenAI is still being underestimated.

PE firm Coatue noted in a recent report that AI is being adopted at a faster rate than other massive platform shifts such as Smartphones and the Internet. Forecasts indicate that GenAI could drive huge productivity gains across many industries. And chip giant Nvidia recently reported that its Q4 2023 revenue soared 265% above the same period a year ago thanks to sales of its AI GPUs.

Certainly, there are hurdles GenAI must clear to fulfill its potential. These include addressing the problems with hallucinations, security, disinformation, and the reluctance by larger enterprises to fully embrace it. Regulatory and environmental challenges also loom.

Still, the strongest signals suggest GenAI is the most important computing platform of our generation.

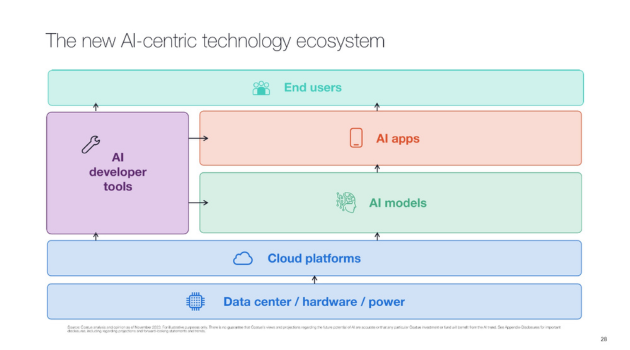

Because it is also such a paradigm shift and evolving so rapidly, Revaia has found it instructive to analyze the different components of the GenAI ecosystem: Data centers, cloud platforms, AI models, developer tools, and applications.

AI Models

This is where the heat is. The companies building the large language models powering GenAI are raising by far the most money from investors: OpenAI, Mistral AI, Aleph Alpha, and Anthropic.

Building these AI models requires a huge amount of data and computing power to train the foundation models, which in turn requires huge amounts of capital. At the moment, these companies are at the center of the ecosystem and have reached valuations that will make it hard for most investors to participate, even in new companies that come along in this category.

Cloud Platforms, Data Centers, and Hardware

This is the foundation on which GenAI is built. And there are really 2 tiers here.

At the lowest level, there are giants like Nvidia selling the chips to data centers. Several other juggernauts like AMD and Intel are also making plays with hardware.

One step up are the Cloud Platforms or “hyperscalers": AWS, Google Cloud, and Microsoft Azure. European companies are trying to compete, such as Scaleway and OVHCloud. But in general, it is a layer dominated by tech giants.

Between these two elements, the opportunities for disruption from a new player and the investment opportunities that such challengers would bring are not so obvious.

It’s the next two categories where things may start to get more interesting for most investors.

Developer Tools

Leveraging the raw power of GenAI still requires quite a bit of work before people or companies get something that delivers practical utility. To bridge that gap, a growing array of developer tools are emerging to facilitate AI-related IT operations.

There is now a growing field of AI “Operations” – or AI OPs – that complements Machine Learning “ML” Ops. Within this field, new services help address some of the limitations of Large Language Models (LLMs), leading to the creation of a tech stack specific to GenAI. They include tools that help select data to train models, improve data quality, optimize the models through rapid testing, and deploy.

These services help fine-tune models, make data more transparent, and make the GenAI more precise. In this regard, Vector Databases are becoming an increasingly critical link in this chain.

Vector Databases store unstructured assets such as documents, images, and audio that can’t be broken into pieces that would traditionally align with the tabs of a classic relational database. By storing these objects as “vectors” with identifiers, a model that searches through the database can understand what they are and how they relate to other assets.

Such Vector Databases are now becoming an important component of creating applications for end users.

Applications

The application layer is primarily comprised of digital products that are user or consumer-facing. These include products that are strategically located across workflows, or that use proprietary sets of data. Such applications may be in the perfect position to truly reap the benefits of GenAI.

Vertical solutions could be even more interesting in that respect. Solutions that leverage industry-specific data, or even semi-proprietary data, can deliver real value in the short term for users working in those verticals.

One could see interesting end-user-facing use cases. For example, imagine a customer that stays in a Mews hotel experiences greater customer care supported by some GenAI components.

As we noted above, all of these categories are evolving rapidly. They will likely splinter into even more sub-categories to address problems as they are identified. And even for the most powerful technical solutions, there remains the challenge of proving whether it can become a true, standalone business, or whether it will ultimately be a feature set in a much broader solution.

It is hard to say with confidence which of these categories makes for the best investment target. But tremendous value is being created here. GenAI and the ecosystem growing around it are poised to make a tremendous impact. Investors must continue to follow these developments closely and educate themselves, both to spot new opportunities and to offer guidance to existing portfolio companies as they try to adapt.